FedNow® Accounting for Real-Time Reconciliation, Batch RfP, and Payer Databases

“Our mission at TodayPayments.com is to simplify, accelerate, and secure financial reconciliation for every U.S. business using the FedNow® Service. We enable merchants, banks, and payees to automate FedNow accounting with certainty, precision, and real-time control.”

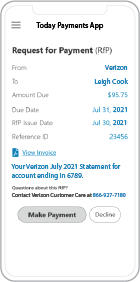

TodayPayments.com empowers modern businesses with FedNow®-ready tools for accounting automation. From Positive Pay to RfP batching, we turn complex ISO 20022 message flows into intuitive, Excel-ready solutions. Whether you're reconciling bank activity, aging outstanding RfPs, or uploading batch payments—Today Payments makes FedNow accounting frictionless, fraud-resistant, and fast.

FedNow® Parameters, Attributes, Benefits, and Features

A New Era of Accounting Intelligence with

FedNow®

A New Era of Accounting Intelligence with

FedNow®

The arrival of FedNow® real-time payments is

revolutionizing how businesses and banks manage accounting

workflows. Gone are the days of waiting for batch ACH settlements or

reconciling delayed wire transactions. With FedNow Accounting,

you gain access to instant reconciliation, real-time

Request for

Payment (RfP) aging, and structured ISO 20022 reporting that

transforms how you manage payables, receivables, and fraud risk—all

powered by TodayPayments.com.

✅ 1. Bank Reconciliation in Real Time

FedNow® enables instant credit notifications that support automated daily bank reconciliation, unlike traditional ACH or wires that settle in batches. Businesses receive confirmation within seconds, matching deposits with RfP IDs or structured invoice references. This reduces month-end backlog and provides true "good funds" visibility 24/7/365.

✅

"FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

✅ 2. Aging of Request for Payment (RfP) Transactions

FedNow supports full RfP aging reports, allowing your accounting team to track outstanding receivables and unpaid requests.

Using ISO 20022 fields like <XprtnDtTm> (Expiration Date Time) and <ReqdExctnDt>, merchants can create aging summaries:

- Current (0–15 days)

- 30/60/90+ day unpaid RfPs

- Export to Excel or integrate with QuickBooks.

✅ 3. FedNow Positive Pay for Fraud Protection

FedNow® doesn’t use checks—but you can implement FedNow Positive Pay logic by pre-authorizing payees, RfP amounts, invoice numbers, or aliases. Requests outside of your internal controls are flagged, just like check fraud alerts. TodayPayments.com provides a FedNow Positive Pay module that emulates dual-verification and alias validation before executing funds transfer.

✅ 4. Payee Creates a: “Payer Database”

Your FedNow Accounting workflow starts with a structured Payer Database, stored in Excel, XML, or JSON. This database allows payees to:

- Track payer behavior

- Assign unique RfP tokens

- Reconcile payments by alias, phone, or email

a. Excel Spreadsheet: “19 Fields of a Usual RfP”

Includes:

- Invoice ID

- Amount

- Currency

- Expiration Date

- Payee alias

- Payer alias

- Remittance info

- Due date

- Execution date

- and more…

b. Excel Spreadsheet: “70+ ISO 20022 Fields”

Full ISO 20022 spec with:

- <GrpHdr> (Group Header)

- <RFPId> (Request ID)

- <Dbtr> / <Cdtr> (Debtor/Creditor)

- <XprtnDtTm> (Expiration)

- <RmtInf> (Remittance Info)

- <PmtInf> structures for batching

Download templates available at TodayPayments.com.

✅ 5. Batch RfP: Request for Payments in a BATCH (2 to n)

Using FedNow® via ISO 20022, you can send 2 or more RfPs in a single batch file:

- Efficient for subscription services, B2B billing, and payroll

- Supports .xlsx, .xml, .json formats

- Upload batch to any bank or credit union that supports FedNow

Payment File Formats: ISO 20022 Message Specs

|

Format |

Usage |

|

XML (pain.013.001.07) |

Structured RfP |

|

Excel (.xlsx) |

Merchant-friendly upload |

|

JSON |

FinTech and mobile API integrations |

Rich ISO 20022 Messaging for Accounting Precision

With ISO 20022 as the core messaging layer, businesses can:

- Match payments to invoices using <EndToEndId> and <RmtInf>

- Timestamp and auto-expire unpaid RfPs

- Reconcile bank entries with certainty across A2A, B2B, and C2B flows

Integrating FedNow transactions into your spreadsheets for accounting, bank reconciliation, and managing the aging of Request for Payments (RfP) involves creating a systematic workflow. Here's a guide on how you might structure your spreadsheet, considering different accounting methods (Accrual, Cash, Hybrid) and the concept of Undeposited Funds:

1. Spreadsheet Structure:

- Set up columns for essential details: Date, Payee, Amount, Transaction Type, FedNow Transaction Reference, and any other relevant information.

2. Accounting Methods:

- Differentiate between Accrual, Cash, and Hybrid methods using a column to specify the accounting treatment for each transaction.

3. Undeposited Funds:

- Create a separate worksheet or section for Undeposited Funds. This could include columns for Date, Amount, and a status indicator (e.g., "Deposited" or "Undeposited").

- Create a Bank Reconciliation worksheet that mirrors your actual bank statements. Include columns for Date, Description, Withdrawals, Deposits, and Balance.

✅ "FREE" RfP Aging & Real-Time Payments Bank Reconciliation – with all merchants process with us.

To support merchants and finance teams of all sizes, TodayPayments.com offers free downloadable templates, including:

- Aging Accounts Receivable Worksheet: Pre-built with 15, 30, 60, 90+ day tracking

- Bank Reconciliation Templates: Instantly match payments with deposits across batches

- ISO 20022 File Format Samples: Plug-and-play structures for batch uploads and RfP message testing

5. Recording FedNow Transactions:

- Enter FedNow transactions into the main accounting worksheet. Use different rows for each transaction, specifying the accounting method and any relevant details.

6. Undeposited Funds Management:

- Update the Undeposited Funds worksheet as FedNow transactions are recorded and funds are deposited. Ensure that this aligns with your Bank Reconciliation.

7. Aging of Request for Payments:

- Develop an Aging Report section or worksheet to track the aging of Request for Payments. Include columns for Invoice Date, Due Date, Payment Status, and FedNow Transaction References.

- Recording Transactions:

- Enter each FedNow transaction into the main accounting worksheet, specifying the accounting method.

- Undeposited Funds Management:

- Update the Undeposited Funds worksheet as transactions are recorded and funds are deposited.

- Bank Reconciliation:

- Regularly update the Bank Reconciliation worksheet to match your actual bank statements.

- Aging of Request for Payments:

- Track the aging of Request for Payments in the Aging Report worksheet.

Notes:

- Consistency is Key: Maintain consistency in updating all relevant sections of the spreadsheet to ensure accurate accounting.

- Regular Reconciliation: Conduct regular reconciliation between your Bank Reconciliation and Undeposited Funds to ensure accuracy.

- Customization: Tailor the spreadsheet structure to meet the specific needs of your organization.

- Stay Informed: Keep abreast of any changes in accounting standards or regulations that might impact your recording practices.

This approach allows you to manage FedNow transactions comprehensively, providing visibility into accounting, bank reconciliation, and the aging of Request for Payments within a spreadsheet environment. Adjust the structure based on the specific requirements of your organization.

Power FedNow® Accounting with TodayPayments.com

If you’re a merchant, bookkeeper, CFO, or accountant trying to bring FedNow into your ledger—look no further. TodayPayments.com gives you everything you need to:

- Create aging reports

- Automate FedNow reconciliation

- Batch upload RfPs with ISO 20022 templates

- Build payee-payer databases

- Stop fraud with FedNow Positive Pay logic

✅ Get started with your free FedNow Accounting Workbook and instant RfP XML generator at www.TodayPayments.com

ACH and both FedNow Instant and Real-Time Payments Request for Payment

ISO 20022 XML Message Versions.

The versions that

NACHA and

The Clearing House Real-Time Payments system for the Response to the Request are pain.013 and pain.014

respectively. Predictability, that the U.S. Federal Reserve, via the

FedNow ® Instant Payments, will also use Request for Payment. The ACH, RTP® and FedNow ® versions are "Credit

Push Payments" instead of "Debit Pull.".

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.